Autumn Budget commentary

OCTOBER 2024

Click the relevant image below to view video commentary

Read on for commentary from Ian Kelly, Tax Partner

And so there we have it, Labour’s first Budget for 14 years and the first by a female Chancellor of the Exchequer.

Rachel Reeves at times showed a few nerves, as a couple of stumbles over a word or two proved, but even speaking with the advantage that a huge majority brings, this was, perhaps, understandable.

What we didn’t know when she stood up just after twelve thirty immediately after Prime Minister’s questions, was that she would still be on her feet 77 minutes later. Reeves had bravely countered some early dissention in a measured tone but the later quietness in the air in the House of Commons maybe had something to do with the fact that, as her speech progressed, it had a touch of tedium about it, all of the major announcements having been done.

Ultimately, Reeve’s first Budget will, perhaps, be viewed for what it didn’t include than what it did.

The widespread pre-Budget rumours of a multi-pronged attack on all things pension; major changes to Inheritance Tax and dramatic increases in Capital Gains Tax rates all came to nothing.

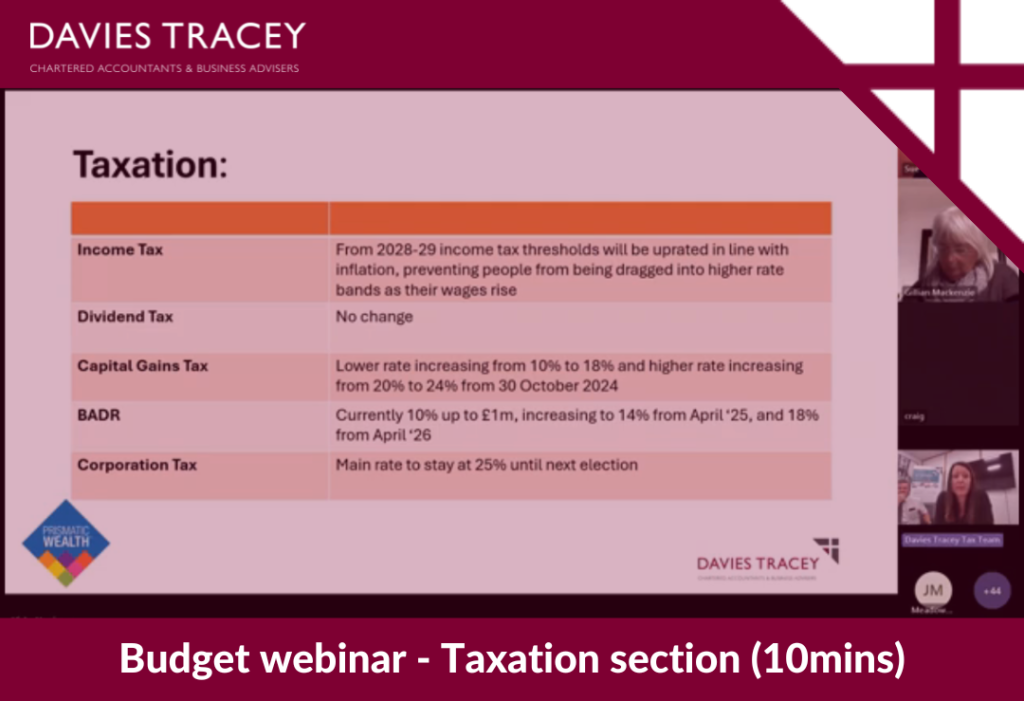

As I started to write this commentary I went back in time to my report of Rishi Sunak’s second Budget in March 2021. Back then, Sunak announced that the personal allowance and higher-rate thresholds of income tax would be frozen at 2021-22 levels for the four years up to and including 2025-26. At Autumn Statement 2022 Chancellor Jeremy Hunt extended the freeze by a further two years and the serious money was on Reeves prolonging Hunt’s timeframe. The surprise, however, was Reeves announcing that freezing would end in April 2028 and at which point uprating would kick in once again.

Of course, this stealth tax means more people have been and are being exposed to paying tax, or more tax, whether this is basic rate or the higher rate. Of late, the effect of two years of increases in the State Retirement Pension has been to drag some pensioners into paying tax with the pension outstripping the personal tax allowance, more on this later.

Reeves was quickly into her stride in telling MP’s that there would be the publishing of a line-by-line account of the £20m ‘black hole’ and which had effectively become double that.

Recent Conservative Budgets had regularly included reference to “growth” and Reeves used “Get Britain Working” as her first strapline, although the “g” word did feature.

What follows is a brief overview of some of the Budget announcements; please do not hesitate to speak with your usual Davies Tracey contact to discuss these in more detail.

– The reform to the High Income Child Benefit Charge to base it on household income will not proceed

– From April 2025 the rate of employer’s National Insurance will increase by 1.2% to 15% and at the same time the secondary threshold will reduce from £9,100 to £5,000

– The Employer Allowance will increase from £5,000 to £10,500

– Legislation will abolish the remittance basis of taxation and replace it with a simpler regime, effective from 6 April 2025. Individuals who opt in to the new regime will not pay UK tax on foreign income for the first four years of tax residence

– The 10% Capital Gains Tax rate will increase to 18% and the 20% rate to 24%. The residential property rates will remain at 18% and 24%

– The Business Assets Disposal Relief (BADR) lifetime allowance will remain at £1m but the 10% rate will rise to 14% in April 2025 and 18% from April 2026

– The State Retirement Pension triple lock will remain in place but the 4.1% increase, whilst welcome to pensioners, might well produce a rate of pension on which tax might be payable

– The Inheritance Tax (IHT) Nil Rate Band (NRB) and Residence Nil Rate Band (RNRB) will remain at £325,000 and £175,000 but will be frozen for a further two years to 2030

– From April 2027, inherited pensions will form part of an estate and so exposed to IHT

– There will be a £1m combined 100% Business Property Relief (BPR) and Agricultural Property Relief (APR) exemption with any balance over £1m attracting 50% relief as will also be the case for Alternative Investment Market (AIM) shareholdings

– There will be a Corporation Tax (CT) roadmap which, together with a 25% CT rate for the duration of the parliament is designed to provide surety

– The Annual Investment Allowance (AIA) and full expensing remain in place. The government will explore extending full expensing to assets bought for leasing or hiring,

– Fuel duty is to remain frozen and the 5p cut for one year extended to 2025/26

– There will be a fairer business rates system reflecting lower business rates multipliers for retail, hospitality and leisure

– The Stamp Duty Land Tax (SDLT) rate for the purchase of second homes and buy-to-let residential properties will rise from 3% to 5% from 31 October 2024

– There will be increases in fraud and error staff in the Department for Work and Pensions and HMRC compliance staff and debt management staff to target fraud and error in the welfare system and in closing the tax gap respectively

– The capital treatment afforded to carried interest will change to an income tax regime from April 2026. In the meantime, the CGT rate thereon will increase to 32%

– To provide certainty the company car tax rates are to be set for 2028/29 and 2029/2030

– Following a Court of Appeal judgement, double cab pick up vehicles with a payload of one tonne or more will be treated as a car from 6 April 2025. The existing capital allowance and benefit kind regimes will apply to those purchased before April 2025. Transitional benefit in kind arrangements will apply for employers that have purchased, leased or ordered a vehicle before 6 April 2025 whereby they will be able to use the previous treatment until the earlier of disposal, lease expiry or 5 April 2029